Unleashing liquidity: the rise of liquid staking in Cosmos and the role of Stride

With the LSM (liquid staking module) live in the hub, stride is very well positioned for the future.

Liquid staking within the Cosmos blockchain ecosystem introduces a groundbreaking paradigm shift in the realm of decentralized finance (DeFi). While traditional staking mechanisms offer users attractive yields, they often present a trade-off by locking tokens, limiting their utility in other decentralized financial applications. Liquid staking emerges as a solution to this challenge, fostering enhanced capital efficiency and empowering users to participate more actively in DeFi opportunities.

The Core Challenge: Capital Lockup in Traditional Staking

When users stake tokens in a traditional staking model, they commit their assets to a chosen validator or even opt to run their own validator node. In return, they receive staking rewards as an incentive for contributing to the security and consensus of the underlying blockchain protocol. However, this engagement comes at the cost of token lockup, restricting users from fully utilizing their assets in dynamic and evolving DeFi ecosystems.

Liquid Staking: Unleashing Capital and DeFi Potential

Liquid staking disrupts this conventional approach by allowing third-party entities to pool and delegate substantial amounts of tokens to validators of their preference. In exchange, users receive liquid staked tokens (LST), specially issued by these entities. What sets liquid staking apart is the dynamic nature of LST, which accumulates value over time through the reinvestment of staking rewards.

The key differentiators of liquid staking can be listed as:

Liquidity and Accessibility: Liquid staking liberates tokens from the confinement of traditional staking, providing users with a fungible and tradable asset (LST). This newfound liquidity empowers users to seamlessly engage in various DeFi protocols without compromising their staking rewards.

Optimized Yield Generation: Liquid staking platforms strategically reinvest staking rewards into the issued tokens, compounding their value over time. This dynamic yield optimization contrasts with traditional staking, where rewards are often received in the native token, subject to market fluctuations.

DeFi Integration: The liquid staked tokens become versatile assets that users can seamlessly deploy in decentralized finance applications. This integration allows users to explore lending, borrowing, yield farming, and other DeFi opportunities while still benefiting from the underlying staking rewards.

Risk Diversification: Liquid staking introduces a layer of abstraction from the complexities of direct staking engagement. Users can leverage third-party services to manage the staking process, potentially reducing the technical barriers associated with running individual validators.

In essence, liquid staking emerges as a catalyst for broader DeFi adoption within the Cosmos ecosystem. By mitigating the trade-off between staking and liquidity, it facilitates a more dynamic and interconnected financial landscape where users can maximize the utility of their assets while actively participating in the security and growth of the underlying blockchain protocol.

The new avenue for Stride in Cosmos

The staking yield in most Cosmos chains right now is enough for many users to settle with that yield staked instead of risking loosing money on market makers. Therefore, it’s difficult to incentivize users to provide liquidity.

Right now, Stride (the main liquid staking provider in Cosmos) has $35M worth of liquid staked assets with them. But the potential for stride is much larger. In Ethereum, the main liquid staking provider is Lido Finance, which has become a huge player accounting for more than 30% of all staked ETH. This market usually is a winner-takes-all market, and the first players have a huge advantage, and we believe that Stride will be a huge player and one of the most important Cosmos chains because of that.

Cosmos Liquid Staking Module (LSM)

Cosmos hub currently holds around 247M $ATOM staked. The LSM does have a cap: 25% max of all staked assets can be Liquid Staked, but they can do so without waiting for the unbonding period to end. This means that now that the LSM is live, around 62M ATOM can be liquid staked, a total amount of around $419M.

Taking into account that there are three main liquid staking providers in cosmos (Stride, Persistence, Quicksilver), I find it easy for Stride to hold almost half of the said assets. That would mean around $210M, which is 6 times more than it currently holds with all chains combined.

The scope of this report is to measure the possible revenue of stride based on different scenarios, using only the Cosmos Hub side. As a last-minute addition to this article, it is definitely worth mentioning the last-minute news: the Stride team has posted a forum on the Hub to pave the way towards an eventual merge between Stride and the Cosmos Hub. Therefore, we will separate the following sections in two.

Current Stride revenue generation

As of the writing of this article, staking STRD allows users to receive staking rewards, which consist of STRD as well as staking rewards collected from liquid staked tokens. It also allows for users to vote.

Stride has a hard cap of 100M tokens. In prop 8, STRD stakers voted to include all staking rewards collected in the STRD staking reward. Stride protocol collects 10% of the staking rewards of all liquid staked tokens. With a TVL of $36M and a blended staking reward rate of 21% APR, the Stride protocol is currently collecting $756,000 yearly. This means:

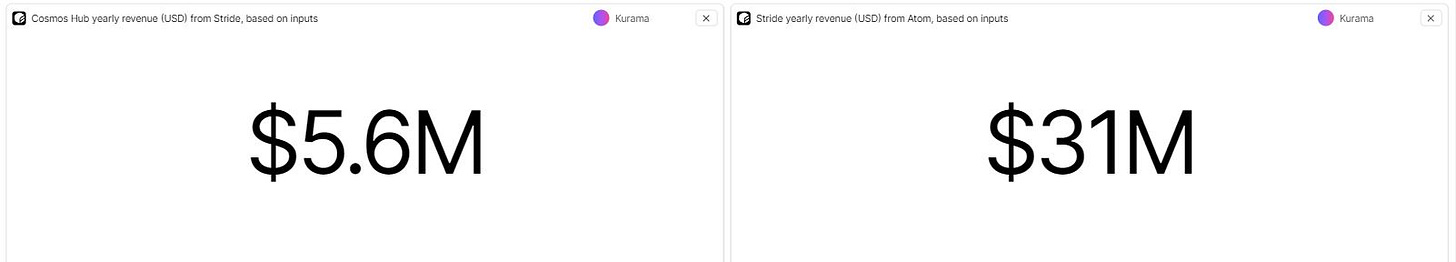

If there were $100M in Atom liquid staked in Stride, and staking APR for Atom is 18.85%, Stride collects and distributes within STRD stakers 10% of that APR, which means Stride would collect annually around $1.9M just from Atom.

Out of those $1.9M, 15% goes to the Hub and the rest (around $1.6M) goes to stride stakers, in the form of stATOM.

On top of that, stakers also receive STRD due to STRD emissions.

As stated above, this is a winning situation also for the hub, since 15% of stride revenue is shared with the hub.

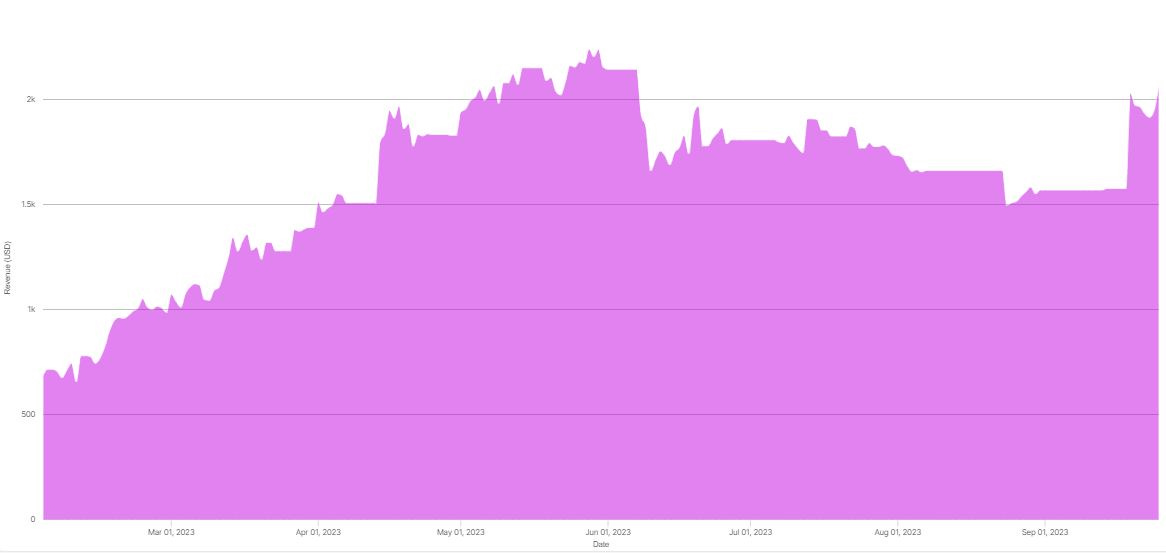

The image above shows the daily revenue of stride, taken from DefiLlama API. Annualized, this is around $600k in revenue.

Current Stride revenue projection

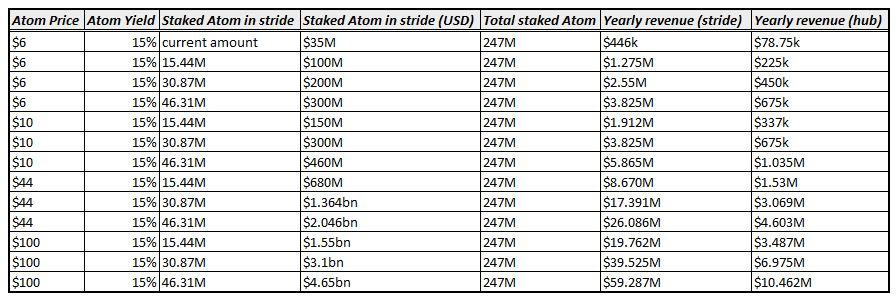

There are of course many things that can influence the revenue side, but we can do some projections, based on the price of Atom, the staking yield, and the amount staked in Stride.

We’ve limited the total amount in each scenario to max 46M staked Atom currently, which would account for 75% of what’s allowed through the LSM. Of course, this can vary and it could eventually reach 100% of all staked Atom, so our approach could even be considered “conservative” in that regard.

In a scenario where Atom reaches its previous ATH at around $44, with 75% of all the Atom allowed by the LSM, this would mean a yearly revenue of $26M for Stride and $4.6M for the Hub. We can do the maths for all 240M staked Atom, and the revenue would be astronomical.

And this is where Stride and Lido differ. As far as I’ve been able to understand, Lido revenue goes to the protocol, but it’s not delivered through its token. LDO stakers do not receive any revenue from the protocol. Lido Finance charges a fee of 10% of each investor's profits, of which 50% is used to improve the platform and provide coverage and privacy for consumers.

Current revenue distribution

As we’ve already stated, the huge attraction for the $STRD token comes from the revenue generated by the protocol.

The total staked STRD tokens is currently 20.33M STRD. If one would hold 50.8K STRD at the current price ($0.8, $40.6k), that would be 0.25% of all staked STRD. If that proportion maintains over time (tricky to calculate due to unstaked STRD and inflation):

For a yearly protocol revenue of $446k, this user would receive $446k*0.25/100 = $1.1k yearly in protocol revenue.

For a yearly protocol revenue of $1M, this user would receive $1M*0.25/100 = $2.5k yearly in protocol revenue.

For a yearly protocol revenue of $40M, this user would receive $446k*0.25/100 = $100k yearly in protocol revenue.

This is a huge driver for the price of Stride long term, but short term only the market knows. It’s been a week since the LSM has gone live, and the total liquid staked amount has not increased that much, as one can see here.

We have also built the following tool which takes as input:

Atom price

Staking yield

Total staked Atom

Percentage of ALL staked Atom liquid staked in stride

The tool is available here, and it returns two charts such as this ones:

Those values are calculated based on the default numbers ($10 Atom, 15% yield, 247M Atom liquid staked through stride).

Stride proposal to merge with the Hub

The proposal is still in the making, and so far the Stride team wanted to pitch the idea to the whole community, which personally is a great example; an open conversation with no “closed deals” behind it.

As seen in the comments in the forum, the idea is to convert all STRD to ATOM and Stride would become a satellite chain, with 100% of the revenue going back to the hub. From the Stride core developers and the whole Cosmos ecosystem (and specifically the Hub) point of view, this would make sense, since:

With the launch of dYdX and Celestia, the Hub might lose its main strength: being the largest Cosmos chain by market cap, and therefore Stride security too since they’re entangled.

Fully aligning incentives between both the Hub and Stride, the Hub would “buy” a dedicated team.

With Stride becoming fully decentralized (Atom is way better decentralized than Lido governance for instance), other appchains (Celestia, dYdX, etc.) might be more comfortable using Stride.

However, the procedure by which the conversion from Stride to Atom would be done is still unclear, and as seen by the price action since the announcement and the previous section of this article (revenue distribution to STRD stakers), the Stride token holders don’t seem to be convinced.

It seems that the proposal will not be pushed forward, at least not for a while. Following the the latest explanation from four Stride core contributors, their vision for the Hub has become clearer:

The Hub needs to gain relevance, and Stride depends on the hub for security; therefore, if the Hub fails, Stride falls with it.

There was a discussion envisioned in 2021 where the Cosmos Hub would be like a port city, which didn't garner enough consensus. Stride contributors still believe the city idea would make sense, along with interchain security. Converting STRD to ATOM would mean the Hub controls the core utility of liquid staking, serving as the city's first service.

Moreover, they envision a world where all STRD, OSMO, and STARS would be converted to ATOM. In this scenario, this "city" would have three core utilities: liquid staking, exchange, and culture—without compromising the Hub's minimalism and avoiding a monolithic structure (liked by IBC, featuring interchain security).

As they state, BTC and ETH are perceived as the "monies" of the Web3 economy, serving as a store of value and medium of exchange. In the case of ATOM, the compelling story that would appeal to the Web 3 space is this:

ATOM is the oldest and most decentralized governance token, controlling a suite of interchain services.

Whether all of this makes sense at a legal, business, and economic level, it certainly appears to be a promising idea for the Hub. Most importantly, it has been open and transparent from the start, whether it reaches consensus or not throughout the interchain.

Conclusions

In conclusion, liquid staking in the Cosmos blockchain ecosystem represents a transformative leap forward for decentralized finance (DeFi), addressing the longstanding challenge of capital lockup associated with traditional staking. By offering users the ability to trade in liquid staked tokens (LST) that accrue value over time, liquid staking enhances capital efficiency and facilitates active participation in diverse DeFi opportunities.

As the Cosmos ecosystem navigates the challenges of incentivizing liquidity provision amid substantial staking yields, Stride emerges as a key player in the liquid staking landscape. With $35 million in liquid staked assets, Stride has the potential to follow the footsteps of major players like Lido Finance in Ethereum, capturing a significant share of the market. As the first-mover advantage often prevails in this space, Stride is poised to become a pivotal force in the Cosmos blockchain ecosystem.

The Cosmos Liquid Staking Module (LSM) introduces a new dimension to staking dynamics. In this evolving landscape, Stride, along with other providers like Persistence and Quicksilver, is positioned to play a crucial role in managing and distributing a substantial portion of these liquid staking assets.

Stride's current revenue model, driven by staking STRD tokens, sets the stage for a lucrative proposition for users and the Cosmos Hub alike. With a 10% collection from staking rewards of all liquid staked tokens, Stride demonstrates a sustainable path to revenue generation. As Stride's total value locked (TVL) stands at $36 million, projections indicate a potential annual revenue of $756,000. The symbiotic relationship between Stride and the Cosmos Hub, where 15% of Stride's revenue is shared, aligns incentives for both entities.

Looking ahead, revenue projections for Stride are contingent on various factors such as the price of Atom, staking yield, and the percentage of staked Atom within Stride, as well as other assets liquid staked through Stride. Conservative estimates indicate substantial revenue potential, with scenarios projecting annual revenues ranging from millions to tens of millions, depending on Atom's market performance. Stride's current unique feature of distributing revenue to STRD token holders further solidifies its long-term attractiveness in the ecosystem.

Even if the current proposal of Stride merging with the Hub takes place, all the revenue stated in this research analysis would flow directly to the Hub, which is in turn very positive for the Hub istelf.

While the short-term market response remains uncertain, the long-term potential for Stride is underscored by its innovative revenue-sharing mechanism and the promising prospects of liquid staking in the Cosmos ecosystem. As the Liquid Staking Module gains traction and the market dynamics evolve, Stride's strategic position and revenue-sharing model position it as a frontrunner in the transformative journey of liquid staking within Cosmos.